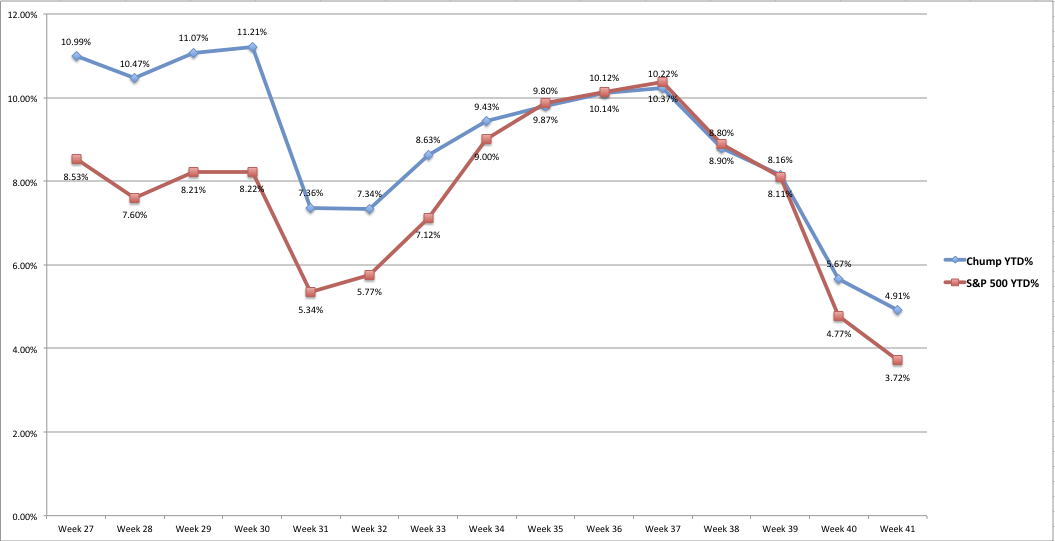

The chart below shows the YTD return of the S&P 500 (red line) vs. the Chump IRA (blue line). As you see from the graph, we've now endured four straight weeks of declining returns. And while it may seem like the bottom has fallen from the stock market, the market has only dropped around 6.5%, not even the "10 percent" correction that everyone has been calling for over the past 2 years.

So keep things in perspective, this is not a big deal, and we are not entering a recession. Use the lower prices to add to undervalued positions you hold, or start new ones.

The Chump YTD returns are starting to gap again with the S&P, not falling as hard in this downturn.

I've been paying close attention to my watch list during this minor correction, but NOTHING has hit my estimated buy price based on fair value, so I'm a little frustrated. Regardless, I needed to build a some cash in the event I'm ready to buy, so I closed my positions in VMI and John Deere (DE).

Not that I don't like VMI and DE, but both have been lowering guidance, and are forecasting declining EPS for at least the next 18 months. Both are subject to farm prices and agri-business spending. I also have a position in ADM, which I'll keep. I decided to close these out, and look for companies that are growing earnings now, pay a growing dividend, and are undervalued.

In a previous blog, I mention Alaska Airlines. I added ALK to my watch list a few months ago, and with the Ebola news, airlines got beat up as a group. Seemed like a good time to "swap" my VMI for ALK...better dividend, better valuation, nice growth in EPS. As the market has continued to correct, I've added to the position.

I also used some of my sale proceeds to add to my positions in HAL and KMI. The entire energy sector is getting beat up, and good companies like these are on sale! HAL pays a small dividend, but is growing it rapidly, and is forecasting 25% EPS growth over the next several years. KMI pays a great yield (see blog from yesterday for more info).

I still have some cash on hand, so I'll wait to see what next week brings.

No comments:

Post a Comment